Reflections on a failed sale

In the previous blog, I mentioned a story I was ready to share.

It involves the sale of my dad's house in Michigan, to the 20-year-old grandson of longtime friends of our family.

When the opportunity arose, in early 2022, I was excited and inspired by the prospect of helping a young person accelerate his ascent on the financial escalator so early in life.

(Imagine if you'd bought your first home at 20 years old.)

I loved that his parents had set aside his "live at home" rent, offering it back to him on one condition:

That he use it as a down payment on a house purchase.

Brilliant.

The young man, having become familiar with my dad's house by raking leaves, mowing the lawn, and shovelling snow in the years before my dad died, had approached me with a proposal.

He'd like to buy it, he said, at market value, if I would provide financing on a land contract (midwest slang for seller financing.)

I agreed, we formalized it, and he took over ownership.

He would have three years from that date to enjoy the house, make the modest monthly payments, ultimately get regular bank financing in place, pay me the balance due, and close the chapter in a real estate story I was proud to be part of.

The 3-year mark arrived on February 1, 2025 -- 3 months ago.

In this newsletter, I'll share how things played out.

Rather, I'll share my version -- what played out for me as the seller and lender, 2000 miles away and handling all of it remotely.

Nothing is one-dimensional, of course.

Some day I'd like to hear or read the young man's version of events.

Nevertheless... I'll share mine.

Top off your glass, and let's visit the events that ensued...

"I can't thank you enough."

When my mom died in April, 2006, my dad left their Arizona home and became a bit of a rolling stone.

He took their relatively modest savings and a small life insurance check, and set out to find the right combination of peace and adventure.

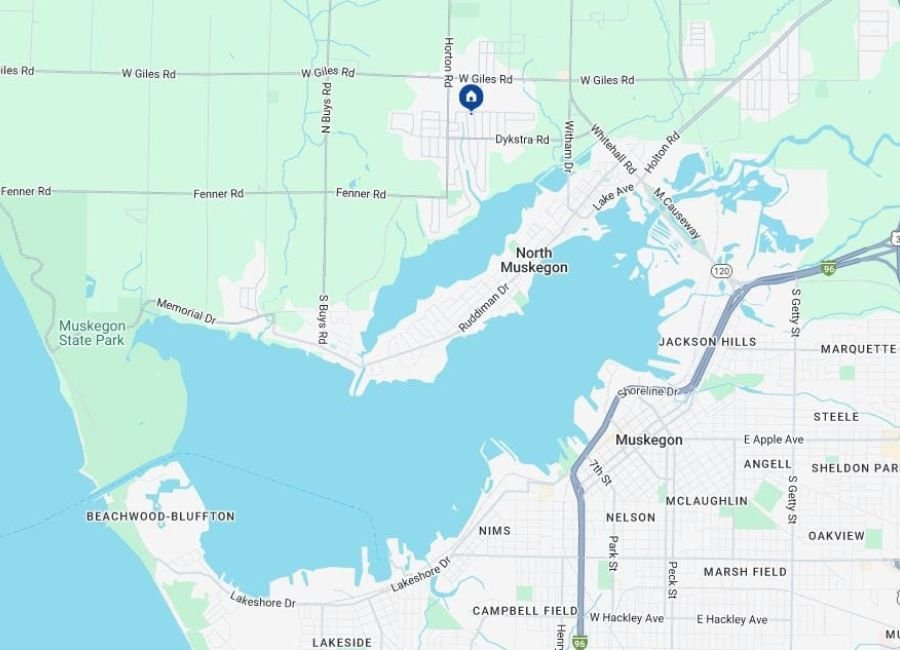

He lived in a tiny cabin in Montana, a house boat on Lake Pend Oreille in Idaho, an apartment on Padre Island, Texas, a double-wide in Englewood, Florida, and eventually -- after about 8 years of roaming around -- he made it back to our hometown of Muskegon, Michigan.

In late 2014, real estate prices in Muskegon had been pretty flat, and were very affordable by west coast standards.

You could find move-in ready 2 and 3 bedroom homes in nice North Muskegon neighborhoods for well under $100K.

I had the idea that, rather than my dad rent from a stranger, I would buy a house, set it up nicely for him, and charge him just enough to cover costs -- well under market rent.

I did some shopping online, sent him addresses to drive by, and we ultimately settled on a 2-bed, 1-bath "Ranch" (one-level) not three blocks from the home our family lived in from 1977 to 1980.

I paid $59,900 for the house.

My dad still had years of golf ahead of him at “Lincoln”, his home course where he'd been head pro earlier in life -- just a few short miles up the road.

He had many hundreds of bluegill and perch to catch during nearby fishing outings with his lifelong friends.

I heard those stories and others during our frequent phone calls.

I will always treasure that on every other call, he would end by telling me how comfortable he was in that little 2-bedroom house.

"I can't thank you enough, son." Those words always warmed my heart.

He was a meticulous housekeeper, and he let me know right away whenever something was needed.

During his time there, we replaced the roof, the furnace, refreshed the paint and some flooring, and put in maintenance and love when and where it was needed.

It was an ideal basecamp for him right up until he moved to hospice, 4 days before he died, in December 2021.

By that time, I had acquired some rental property in Bellingham, and the collective management workload plus running BNP was enough for me, so I decided to sell my dad's house rather than rent it out.

My brother Nick and I were in Muskegon later that same December, 2021, donating my dad's furniture and doing a final clean-up of the house, when the 20-year-old approached me about buying it.

By then, along with the rest of the country thanks to 3% mortgages, the market value of the house had climbed substantially.

The fair market value by then was probably $140K to $145K if I'd gone through a full listing and marketing process.

For the young man, I proposed a price of $130K with the following terms:

His $5000 down payment

4% interest rate

30-year ammortization

3-year balloon (balance due in full)

We would fully formalize this agreement with the help of a title and escrow company, and the creation and recording of the Land Contract (in Michigan this takes the place of a promissory note and deed of trust.)

With these terms agreed to and put in place, the young man had created for himself a remarkable deal:

Beginning on March 1, his monthly principal and interest payments to me were $596.77 -- this is about half of what the house would have rented for.

He would need to make 36 of those payments over 3 years, then pay me the balance due of $117,920.38 at which time our business relationship would be completed.

He could also choose to pay it off anytime prior to that without penalty or cost, whether he refinanced early or sold the house.

With this agreement signed and recorded, it was official, and our 3-year journey was underway.

As the first week of March, 2021 arrived, I watched for that initial payment to hit the mailbox or my bank account.

A week passed, and there was no sign of the payment.

Understandable enough, he surely just needed a bit of guidance.

I called him and explained the beauty of modern auto-pay -- just call or visit your bank, explain the who, when, and how much... and enjoy the convenience of "set it and forget it."

About a week later the payment arrived, and that was that.

Then in April, oddly, same thing: the deadline for payment came and went, but nothing showd up.

I texted him... and again, I finally received it.

The - exact - same for May, June, July, etc.

I had several conversations with the young man about his habit of paying late, and asked why he still hadn't set up auto-pay.

He seemed to be an attentive listener, and the payments were eventually arriving, so I re-set my expectations on when to look for them, and focused on my life and work here in Bellingham.

At the one year mark, with 12 payments made -- but every single one of them late -- I texted the young man and asked him to set aside a chunk of time for a phone call.

On that call, I told him that while the late payments are not a hardship for me, they're concerning in that he is going to have to qualify for a mortgage in 2 years' time.

Had I been a real lender, or reporting him to the credit agencies, his credit score would be tanked and there would likely be no chance of a refinance.

I was helping him, I reasoned, and protecting my impending payday when he refinanced.

I gave him the names and numbers of two lenders there in Muskegon who worked with first-time buyers.

"Make an appointment with one of these people," I said, "and find out exactly what you'll need to do between now and February 1, 2025, to be ready to qualify for the mortgage to pay off our agreement."

There was a long runway ahead of him still, he was gainfully employed as a carpenter, and if he got out in front of things with that lender meeting, he would sail through a simple refinance for that $117,920.38.

Another year came and went, bringing us to February, 2024 -- 12 months from crunch time.

In that previous year, the young man had gotten married, bringing love, companionship, and -- importantly -- another gainfully employed adult into the picture.

He also gained another thing in that 2nd year: A perfect 12-month track record of 12 more late payments.

And, busy with life as we all are, he hadn't yet found the time to consult with a lender.

We got on the phone, this time with both the young man and his wife on the line.

I went over, again, the importance of planning ahead with just one year left to (try to) repair any damage to their credit and be 100% on track for the refinance.

"Call. The. Lender. Like.... TODAY. As soon as we hang up."

"They won't bite. There's no cost.""

"They will > > > G U I D E < < < you to be prepared for the obligation you have approaching like a slow-moving-but-still-actually-moving locomotive."

This time, surely, they got it.

Both of them on the phone, all of us connecting, no language barrier, no complicated, super-confusuing concepts to misunderstand.

I had coached them well, certainly, and they had a year to methodically get everything in place.

It would all work out just fine.

In early May, 2024, 9 months prior to the due date, not only did the payment not show up on time... it didn't show up at all.

Nor did June's.

Nor did July's.

The young couple's <$600 monthly housing payments had just stopped completely.

Let's pause here and re-visit the Land Contract and the language contained therein.

As I've written in this newsletter and I've said countless times: "Real estate is a business of written agreements."

The Land Contract was a powerful document.

It gave me all the power I would have needed to, at that point, cry foul, send a certified letter, and essentially move the young couple out of the house.

There were actually two clauses that allowed for that:

The Right to Forfeit clause, and the Acceleration Clause.

The Right to Forfeit does not mince its words:

If the Purchaser shall fail to perform this contract or any part thereof, the Seller immediately after such default shall have the right to declare the same forfeited and void, and retain whatever may have been paid hereon, and all improvements that may have been made upon the premises, together with additions and accretions thereto, and consider and treat the Purchaser as his tenant holding over without permission and may take immediate possession of the premises, and the Purchaser and each and every other occupant removed and put out.

I was happy to have this clause to lean on, but I wasn't looking to foreclose on the young couple, I didn't want to ruin their credit and compromise the impending refinance, and their grandparents were LIFELONG very, very close friends.

Ugh.

I called the grandparents, and shared that the young couple were 3 (or by then, 4?) months behind on their payments with no communication.

The grandparents were aghast, and said, "Don't worry, we'll call over there right now and find out what's going on."

The next day, the young man called me.

He apologized for the missing payments, and explained that he and his wife had...

(Are you sitting down? You probably should.)

...they had "decided to prioritize paying off her student loans."

I..... I said, "Pardon?"

Yeah. I had heard him right.

"Well that's quite a decision... quite a strategy," I told him.

A discussion ensued, and by then -- late summer 2024 -- there wouldn't be nearly enough time left before the due date for the young couple to get everything in order for a loan.

I explained to him: "You now have two options. You are going to need to find a co-signer, someone with good credit and the ability to take on the hundred-and-twenty grand in mortgage debt, to help you do this refinance."

"Or you are going to have to sell the house."

I explained that EITHER OPTION was very, very much in his best interest, because by then the house had appreciated a healthy amount more, and he now had a strong equity position -- tens of thousands of dollars -- legally his and his wife's.

I sent him my Realtor's name and number there in North Muskegon, and the lender's name and number, again.

"If you find out you can't refinance, for any reason, that is not the end of the world," I told him.

"Home ownership may not be for you just yet, but you're sitting on a small fortune in equity."

(By 22-year-old standards, anway. I mean, the delta between what they owed and what it would sell for was REAL MONEY.)

"Just call this Realtor," I told him, "and have him guide you through a sale... but do it before winter sets in! A brutal Michigan winter is not the best time to maximize your sale price."

I understand, he said.

Uh-huh.

Properly prepared and listed on the open market, the house would, by then, have fetched maybe $170K.

To an investor with cash, no preparation or repairs necessary, the young couple could have easily sold it for $150K or more, pocketed $25K+ and moved on.

I explained this option, and told them my Realtor recommendation could make that happen for them.

"Just. Make. The. Call."

Over the next 45 days or so, the young couple caught up on all the late payments, and we headed into winter.

In early December, I began checking in with the lender whose name and number I had given to the young couple.

The lender shared the good news that they had indeed reached out...

And were taking what we'll call a "staggered approach" to filling out an application.

Their progress, I was told, was occurring in 4 to 7-day intervals.

They called, but hadn't made application.

They created an account to make application, but didn't get any further.

They filled out the applicatoin, but didn't upload supporting documents.

Christmas came and went.

They uploaded some of their documents, but not all.

OK... they have all documents uploaded.

"In no universe do these kids qualify to borrow any money," she told me.

Of course they didn't.

New Year's Day, 2025 -- one month before the due date.

I called the couple.

"Good news!" the young wife shared. "My dad is going to co-sign for us, but we need more time. Can you give us til March 1st?"

Of course, I mean, who could expect them to have gotten everything in order for a February 1st due date, with the craziness of life going on?

I told them to keep working towards the refi, and to watch their mailbox for a letter from me.

The certified mail I sent was a formal announcement that one of two things was to occur:

1) They complete a refinance and pay me the balance due in full no later than March 1, 2025 -- honoring their request for one extra month.

Or...

2) I would exercise the Right to Forfeit clause, which I copied and pasted into the letter, and they would turn the house, all improvements, all equity gained, all monies paid, over to me, by signing a quit claim deed.

They received the letter and called me, this time with the young wife's mom on the call as well.

They'd read my terms, they appreciated the extra month, and they were on track with the co-signer dad for the refinance.

Three weeks went by, it was late January, and I'd heard nothing -- including from title and escrow, which seemed odd, since I was the lender that was about to be paid off.

I left messages with the refi lender, title and escrow, and the young couple, asking for an update.

I called the young man's parents and asked for an update.

Crickets all around.

Then, finally, the young wife and her mom called, and upon answering I knew from her voice something was wrong.

"We were on track with the refinance, with my dad as co-signer," she explained.

"But then escrow let us know that we owe taxes. Property taxes. Three year's worth. We haven't been paying them."

Her dad, upon seeing that late tax bill, immediately backed out.

Whether he didn't have the approximately 6 grand to pay the back taxes, or if he just saw red flags everywhere he looked, he was out.

The young wife broke the news:

"We'll pay the back taxes, but we can't get the loan without a co-signer. We'll be signing the house back over to you. Just let us know what we have to do."

I stood there at my desk at Compass, staring ahead at the wall, not believing my ears.

The young couple, their parents -- both sets -- the grandparents, the lender, the title and escrow reps, a Google search, literally ANY source of minimal initiative or outside guidance looking at the situation, just needed to dial the 10 digits of the local Realtor's number that I had given them multiple times, and say these words into the phone:

"We need to sell a house in North Muskegon, very quickly. Can you help us?"

And they would have walked away, before the end of March, shopping for an apartment or back into the parent's basement, with tens of thousands of dollars in their pocket and a Land Contract fully satisfied.

And I had *wanted* and had *tried* to help make that happen for them.

For 36 months I had been the nice guy, not charging them a single late fee, not reporting their payment debacle, relying instead on coaching them and believing in them, and genuinely wanting this to become a success story.

And it had gotten them -- and me -- to this.

Dang, did we all approach this wrong. Embarassingly wrong.

But in that moment, standing there with the phone, rather than try one last time to get them back on track...

I accepted what it had come down to, I mentally reviewed everything that had played out in the previous 36 months, and then I said into the phone:

"OK. I understand. Later this week you'll get a phone call with instructions to stop in to an office in Muskegon, where you'll sign a document. It will take less than 10 minutes. You have until March 1st to get moved out, and please don't forget the March mortgage payment. I'm sorry it's come to this, and I wish you the best."

Impressively, they made that appointment, signed the document, and got themselves fully moved out by March 1st.

The day after they signed, I was at home with my son Hayden, who I'd been updating as this final month played out.

He knew the details, right up through the news of the signed quit claim deed and that our family now owned a house in Michigan again.

"Watch this," I told him, and I dialed my Realtor's number.

"Rick, it's Brandon Nelson. I have a house in North Muskegon. I need to sell it."

I looked at Hayden, and said, "That's all they had to do."

I recognize, very clearly, that I did not help the situation by being so passive about their late payments.

By enabling them, by not charging late fees, I was at the very least a contributing factor to what eventually played out.

I also took my eye off the ball with the property taxes, and hypothetically might have gotten a letter announcing that the home had sold in a tax lien auction.

I should have built those tax payments into the mortgage, the way a traditional lender would have.

I lucked out.

I've learned some valuable lessons and would handle things differently if I could go back in time.

But here we are.

My Realtor spent a month getting the house back into decent-enough shape to list and sell.

The young couple hadn't at all trashed it, but wear and tear happens.

In early April we hit the market with a list price of $172,500 -- the most affordable, move-in ready home in that part of town.

It was a madhouse, with dozens of showings the first weekend.

We got five offers, we settled on one, and we are now past all contingencies with a favorable appraisal.

It is scheduled to close next Thursday, May 15th, for $191,000.

Dad, if you're up there watching this... heck, if you orchestrated all this as a way to "pay me back" or something... you certainly didn't have to.

But let me just say, "I can't thank you enough."