Using “Price Discovery” to sell your Bellingham Home

In this post, I'm going to bring you up to date on the current sales activity, what prices are doing, how inventory looks, and how today's market compares to the peak Covid market.

I'm also going to explain a key concept you should understand, particularly if you're a seller in this market.

It's the concept of "price discovery."

Price discovery is a process and a term I've come to use with great results in helping sellers (and buyers!) understand how to think of an Actively listed home, when it doesn't sell in the first 5 days as was the norm during Covid.

It's a simple framework that, once explained, has vastly reduced the anxiety many sellers would otherwise feel as they launch into a more unpredictable selling environment.

Let's take a look at what's happening in our market and use it to delve into this helpful concept known as price discovery.

The Shape of the Graph

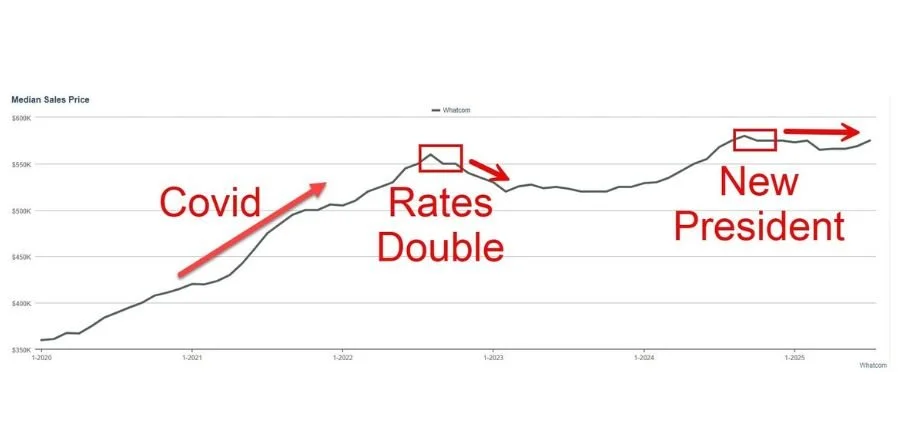

The graph above shows the previous 5 years of median home prices (single family detached and condos combined) throughout Whatcom County.

During Covid we of course had the crazy pricing run-up, fueled by 3% interest rates and mailbox money.

Then, when rates jumped from 3 to 7% buyers slammed on the brakes and we spent a little over a year coming to terms with it, before prices began to steadily rise again.

Then, the presidential election results were announced and the rise is once again halted -- though we see it as more of a "flat market" than a steady decline.

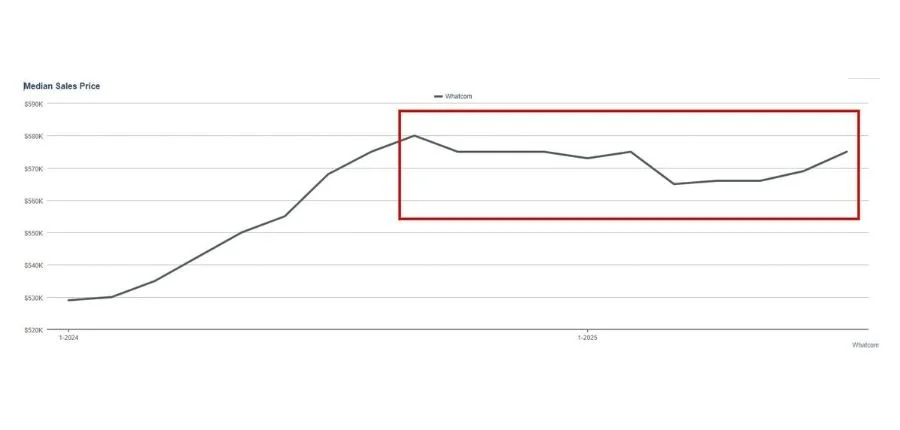

Here's where we're at now, zooming in on the previous 8 months or so:

The technical term for the down - then - level - then - down - then - level then - up - then - ?? section highlighted above is "wonky."

Wonky could be defined as: Hard to predict, no guarantees for a hyper-specific outcome, best approach is a methodical process and heightened skills of "finger on the pulse" observation, versus blind excitement and uninformed expectations.

Also a wonky market has required a new way of speaking to sellers when we talk about pricing.

The Three Pillars of Pricing

Any home's value is a function of three equally important forces, or pillars:

1) Comparable sales -- or other nearby, as-similar-as-possible and as-recent-as-possible sales of other homes.

2) Market trend -- or what direction are things going in? Because buyer sentiment is driven by observable patterns such as "everything's selling quickly with multiple offers" or "most things are sitting, dropping their price, and selling for less than list" -- with a range in between those two.

3) Pricing Process -- or what defined approach did the Seller + Realtor partnership agree on to prepare, list, market, and price the home and -- importantly -- OVER WHAT TIME FRAME?

When I present to a seller during an early meeting, we spend time looking at the comparable sales, or Comps, noting and accounting for differences between properties.

We then get into the current trend, in the context that is relevant to their respective property type, location, etc.

Finally, in this part of the presentation, we talk about that third pillar:

The Pricing Process.

During Covid, it was a very simple conversation:

"Basically everything is selling in the first five days, there are loads more buyers than there are homes for sale, so let's price it slightly below what the comps suggest and get ready for an auction."

We literally called that strategy "The Five-Day Auction" and it worked pretty much every time.

Then -- think back to the marked-up graph above -- things changed.

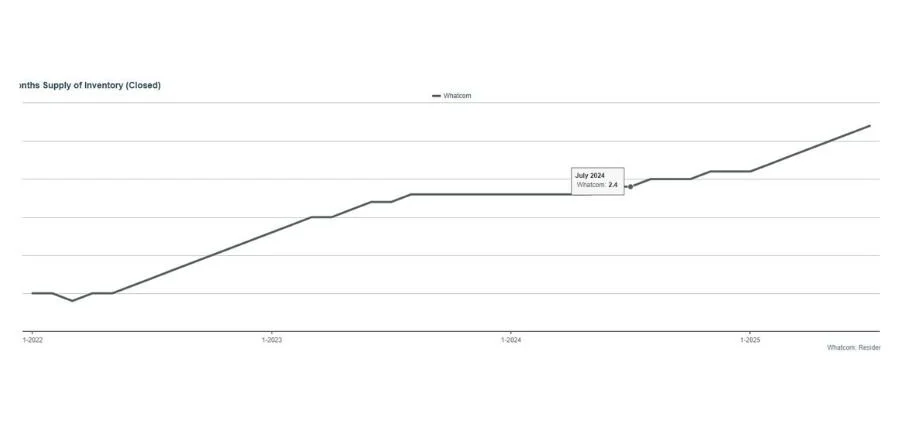

Here's another graph, below, this one known as "Absorption Rate."

It graphs how long the existing inventory would take to be absorbed -- sold off -- if nothing new hit the market.

During Covid it was less than 1 month. Currently it's at 3.2 months and rising.

So What is Price Discovery?

It would be easy to think that a home that sold in today's market, in that first 5 days or so, was "priced right."

And that a home that went into its second week and sometimes well beyond that, was "priced wrong."

Ahh... not exactly.

It's that third pillar: Pricing Process.

Every Realtor wishes they had a crystal ball, and could just NAIL that price out of the gate.

During Covid, you could price way off the mark, and buyers and their 3% (or even lower) interest rates would just swoop in, pay whatever, and make the listing agent look smart.

(How many ads and postcards did you see that boasted, "I just sold your neighbor's house for 23.7% OVER list price!" (Instead of, "I was almost 25% off the mark with my price, but the buyer pool took care of the gap."))

Now, though, it's become (much) more difficult to predict with accuracy what buyers are going to do in this wonky market.

There are still multiple offers and escalation on some sales; Buyers and Realtors are well trained on that from the Covid auctions, and those situations can and do still unfold.

Depending on the property profile, however, the home's characteristics, location and such, an approach of price discovery is more and more applicable, reasonable, and EXPECTED.

The strategy starts with a higher price versus intentionally undercutting the suggested value based on comps, as we do with an auction.

In price discovery, most often used with higher-end priced homes where each home is quite unique and prediction is more difficult, if comps suggest a probable range of $1.4M to $1.6M, we may start at $1.69M.

The preparation and marketing is still optimized the same, to draw maximum eyeballs, intrigue, interest, and visits.

We go into it knowing it's going to take a bit longer, because we priced at or above the top of the probable range, so it requires giving the home enough exposure time on the market to identify what we call a "traffic pattern."

The traffic we're paying attention to is, primarily, in-person visits or "showings."

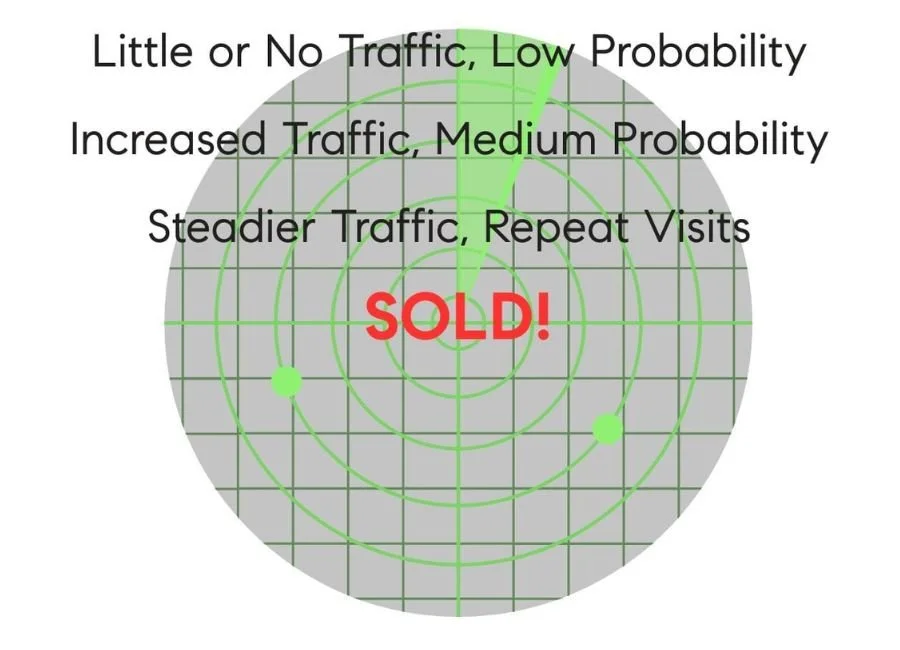

Once we're Active on the market, our radar is tuned to look for these indicators:

How often are we being shown?

Are buyer's agents calling with specific questions during or after a showing -- aka a display of more than just passing interest?

Are we getting repeat visits from buyers seriously considering it?

Have we been the "bride's maid" or runner up a time or two, meaning a buyer almost pulled the trigger on an offer?

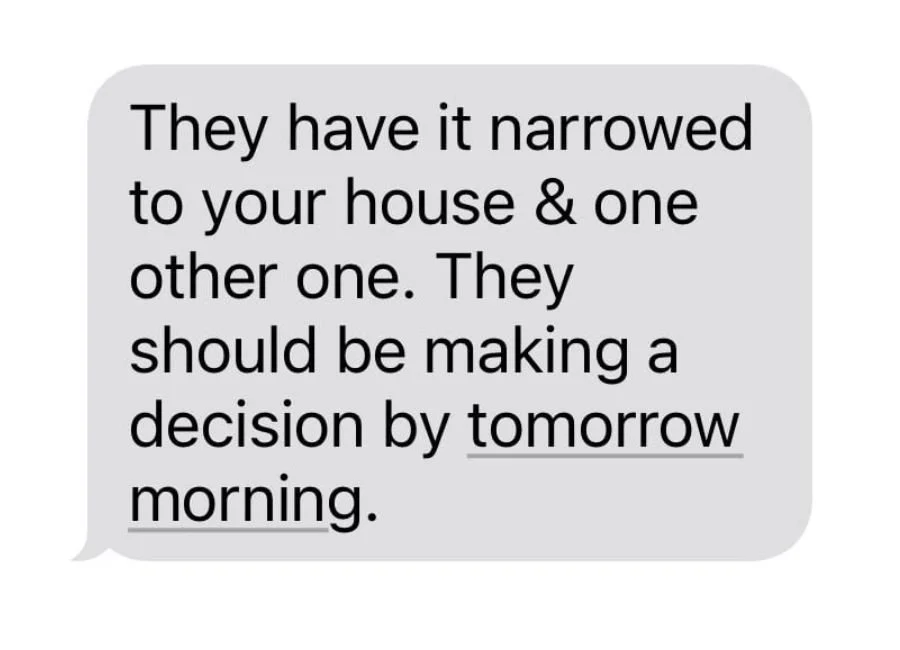

(We're looking for messages like this one below, which I received on one of my listings just yesterday).

Is the feedback positive and encouraging, or are we getting repeating objections we're hearing again and again?

Depending on the traffic and feedback, we are "discovering" where on the "radar" we land.

Then, with the traffic and feedback accounted for, we either stay the course if we're near the target zone for a sale, or if we're obviously on those outer rings, we make an adjustment to get us closer to a bullseye -- closer to a sold.

It's a process, it takes a little bit of time -- more time than during Covid -- though sales are very much still happening continuously in our new, wonky-er market.

Between March and September of 2022 -- peak of the Covid frenzy of sales -- Bellingham saw 512 home sales with an average of 16 days on market, and an average price of $861,000.

In the 6 month period ending today, we've had 421 sales in that price range -- about 18% less sales -- with an average time on market that has essentially doubled to 29 days, and with an average price slightly higher than peak Covid, of $869,000.

So, Sellers, it's still very much happening!

But without the ease-of-over-paying buyers had when rates were at 3%, it takes a bit longer to zero in, and to discover the fair market value.

If you're selling in this market, hire a good Realtor, look carefully at the comps and trends, and then trust the process.

I'll be Carving at SeaFeast!

On September 26th and 27th at Zuanich Park in Bellingham, from 10 a.m. til 5p.m. each day, I will have my carving tools, some ocean-themed pieces, and a large piece actively in the works at the Sea Feast festival!

SeaFeast in an INCREDIBLE festival celebrating the FOOD our local waters provide, our coastal culture of the Salish Sea, and our working waterfront heritage.

https://www.bellinghamseafeast.org/

This year, my good friend Kevin Coleman, the organizer of the event, invited master carver Tomas Vrba and myself to set up shop and share our craft on site.

This is a bucket-list opportunity for me, to carve alongside Tomas and to be in a park setting with friends coming by!

Every piece I bring and make on site will be available for donation, and all proceeds will be donated to a local cause we're still deciding on.

Please plan to come by! (And see the 8 different tools I pick up to make a salmon like this one below).

Come to SeaFeast later this month if you can make it, and I'll see you there!

Meanwhile, have an AWESOME start of the fall season and I'll see you again soon!